How can it be that Scandinavian countries with the world’s highest tax rates at the same time have employment rates and GDPs per capita that are among the highest in the world?

Researchers at the Department of Economics at the University of Oslo argue that a government can generate large tax revenue and facilitate high per capita output and incomes with a progressive tax code if the taxing unit is the individual rather than the household. Associate professor Hans Åsnes Holter is responsible for the project Immigration, Inequality and the Welfare state (IMWEL).

Tax Progressivity and Employment

The IMWEL researchers document a positive relationship between tax progressivity and the employment rates of singles across countries and time. For married couples, they find that with joint taxation, higher tax progressivity is associated with lower employment rates for both men and women. Moving from joint to individual taxation reduces the negative impact of tax progressivity on employment and can turn the relationship positive for married women. The team has constructed a country panel database with 19 years of data on taxes and employment rates for 17 developed economies and developed indexes for tax progressivity and the degree to which married couples are taxed jointly or individually.

Findings

Holter and his colleagues find that an increase in progressive taxation of labour income combined with a shift to individual taxation of married couples may generate more revenue and higher welfare. When married couples are taxed individually, a more progressive tax system leads to higher labour force participation and thus a higher level of labour market experience in the economy.

This happens because as tax progressivity increases, the average tax rate is lowered for low earners. At the same time, more progressive taxation may have a positive income effect on couples’ labour supply if they are taxed as individuals. For a married couple with one high earner and one low earner, the high earner brings home less net income as tax progressivity increases. This creates an additional incentive to work for the low earner who is at the same time getting a higher net income conditional on working due to lower marginal tax rates. Even for single individuals, there may be positive income effects on the labour supply from progressive taxation.

Joint Taxation, Tax Progressivity, and Employment

With joint taxation of married couples, the effect of higher tax progressivity on labour force participation tends to be the opposite, or at least there is no clear theoretical implication that increased progressivity should lead to higher employment. The reason is that the spouses now share the average and marginal tax rates. If one spouse, traditionally the male, is a high earner, the additional benefit of having two workers becomes smaller as taxes are made more progressive. Only in a household where both spouses are low earners do more progressive taxes encourage participation for both.

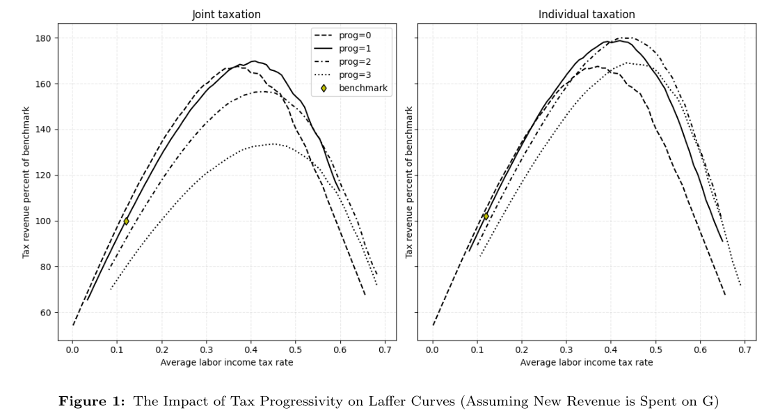

The Laffer curve, which plots total tax revenue from labour income taxation against the level of taxes, shifts up with an individual-based, progressive tax system for labour

income relative to a proportional tax system or a progressive tax system in which the taxing

unit is the household. The maximum tax revenue can be raised with a system that is approximately 60% more progressive than the current U.S. system (about the same

progressivity as in Denmark) on an index of progressivity that the researchers create.

This tax system may generate 12% more revenue than the current U.S. system. The peak is attained at an average tax rate of approximately 41%.

Parallelism on Betzy

Their model is substantial. It contains families and individuals that are heterogeneous with respect to many variables (savings, labour market experience, stochastic labour market risk, age, innate ability, and fixed disutility of participating in the labour market). For all combinations of these variables, the optimal choice of the individuals and families must be computed in the model. The exercise must also be repeated many times for different tax systems (joint vs. individual, tax level, tax progressivity).

This is implemented on Betzy by using OpenMP to parallelize the model solution for a given progressivity and choice of joint vs. individual taxation on each node and looping over the tax level. Using MPI they parallelize across several nodes for different combinations of joint taxation, individual taxation, and the level of tax progressivity.